PGMs to falter in 2012

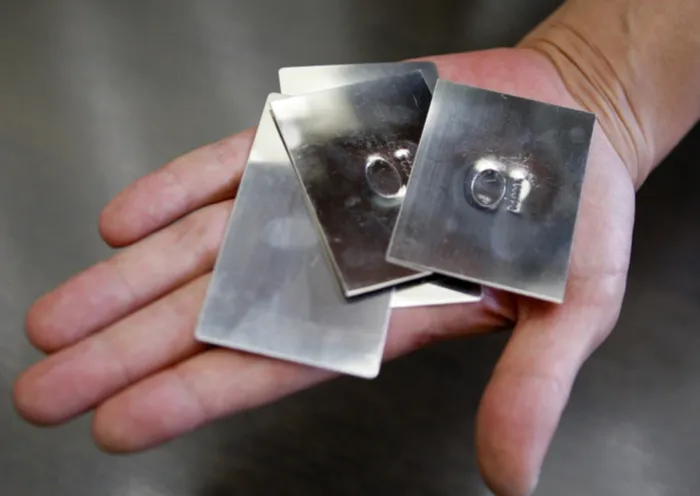

Sheets of palladium are pictured at a jewellery factory. File picture: Yuriko Nakao Sheets of palladium are pictured at a jewellery factory. File picture: Yuriko Nakao

Platinum and palladium prices are expected to struggle in 2012, with analysts drastically scaling back expectations for both metals as the euro zone debt crisis threatens global economic growth, a Reuters poll shows.

For 2013, however, the gradual resolution of the European crisis, together with a resurgence in global growth and constraints to supply is likely to boost prices again in 2013.

The Reuters survey shows the median forecast for platinum at an average $1,610 an ounce this year, down from the median $1,900 an ounce forecast in July 2011 and below the median trading price of $1,765.00 of 2011.

The survey of 29 analysts included views ranging from $1,829.00 to a low of $1,360.00. For 2013, analysts expected an average platinum price of $1,812.50 an ounce.

Platinum's heavy dependence on the broader European economy and demand for catalytic converters means consumption is likely to be constrained this year by the debt crisis, although this could be partially offset by robust Chinese demand for jewellery, another key source of off-take.

Mine supply is expected to grow this year, but the potential for disruptions in top producer South Africa from electricity shortages could be supportive.

“End-user demand will be needed to help investors drive any price rises, and a weak outlook for European automotive output (and hence platinum use) is worrying,” David Jollie, an analyst at Mitsui Precious Metals, said.

“We expect the global economic outlook to improve, aiding industrial platinum demand, and jewellery demand seems to be robust in China, suggesting that some move towards higher prices is likely later in the year,” Jollie said.

“However, with relatively weak fundamentals, it seems unlikely that platinum will trade at an average price in excess of last year's level,” he added. Jollie forecast an average platinum price of $1,575.00 this year.

The platinum price, which fell by 22 percent in 2011, has risen by 15 percent so far in January to above $1,600.00 an ounce, set for its largest monthly gain since February 2008. It was trading at $1,606.24 an ounce by 14:35 SA time.

PLATINUM CATCHING UP

It is also trading at a discount of more than $100 an ounce to gold, although this has narrowed from late December's record low of $218.00 an ounce.

“We believe platinum prices are depressed and reflect an expectation of ongoing and deepening economic stagnation - this explains why it is not trading at well over the $2,000 level,” Ross Norman, director of bullion broker Sharps Pixley, said.

“That said, we see the possibility of significant platinum price gains on South African production shortfalls, on improving investor sentiment and on re-building of physical platinum stocks amongst industrial clients.”

Sharps Pixley expect platinum to average $1,822.00 this year and palladium to average $846.00.

Sister metal palladium is expected to average $725.00 an ounce down from the $868.00 forecast back in July and below the median trading price of $748.30 of 2011.

The survey of 28 analysts offered a range from $846.00 to a low of $555.50. In 2013, the palladium price is expected to rise to average $818.75 an ounce.

So far in January, the palladium price has risen by 6.1 percent to trade just shy of $700 an ounce, having fallen by nearly 19 percent in 2011 on the back of slower demand for cars in top auto market China and disinvestment.

It was last quoted at $692.03 an ounce at 14:40 SA time.

Exchange-traded funds backed by physical palladium lost over a third of their holdings, or 700,000 ounces, in 2011, which contributed significantly to the market showing a modest surplus.

Steady, if slightly more muted growth, in emerging market demand for vehicles, together with dwindling supply from Russia, the world's largest producer, which is expected to virtually cease sales of surplus metal in the government's strategic stockpile, are expected to compensate for softness in the broader economy, analysts said.

“The market has been in a fundamental deficit for the last few years, but sales from Russian official stockpiles have been pushing it into a residual surplus,” Nick Moore, head of commodity research at RBS, said.

“The collapse and subsequent cessation of such sales is expected to see the palladium market enter a period of structural deficits, from 2012 onwards. Palladium remains our favoured metal across both the precious and base sub-sectors,” Moore added. RBS is forecasting an average palladium price of $800 an ounce this year and $1,000 next year.

Refiner Johnson Matthey said in a review of the platinum group metals in November it expected the palladium market to move into a deficit in 2012 from an anticipated surplus of around 725,000 ounces last year. - Reuters