Platinum, palladium set for gains

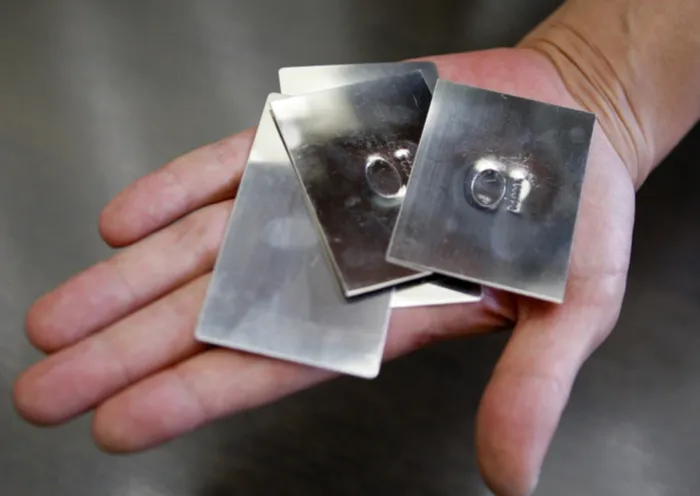

Sheets of palladium are pictured at a jewellery factory. File picture: Yuriko Nakao Sheets of palladium are pictured at a jewellery factory. File picture: Yuriko Nakao

Platinum and palladium are on course for a positive second half of 2012, driven by improved industrial demand and, in the case of platinum, supply cuts, although analysts are much less optimistic than three months ago, a Reuters poll shows.

Both metals have felt the sting of Europe's debt crisis, with erosion of discretionary consumer spending on big-ticket items like cars, the largest source of industrial demand for platinum and palladium.

A broadly struggling platinum price over the past 12 months has forced a number of closures in top supplier South Africa, where a number of miners are now producing at a loss, and where a prolonged strike at a major mine earlier this year removed around 120,000 ounces from the market.

A poll of 19 analysts yielded a median forecast of $1,550 an ounce for the third quarter of this year and a forecast of $1,625 for the final quarter.

For 2012 as a whole, the platinum price is expected to average $1,572.06 and $1,747.50 in 2013, compared with the current year-to-date median of $1,553.24 and last year's average $1,765.00. Three months ago, analysts expected an average platinum price of $1,678.00 this year and $1,800.00 next year.

“High-cost producers are currently losing money on an operating-cost basis and the pressure on the industry can already be seen by some mine closures in South Africa,” Standard Chartered analyst Dan Smith, who expects platinum to average $1,665.00 in 2012, said.

“A small amount has been cut, but further cutbacks are likely in the months ahead. Operating costs have risen dramatically in recent years, as wage rates have soared and industry margins have been squeezed.”

South Africa accounts for 80 percent of platinum supply and its producers have seen output fall sharply over the last year because of industrial action and a flurry of government-imposed safety stoppages.

Even with the U.S. dollar at two-year highs against a basket of currencies, which acts as a major headwind on dollar-priced assets, platinum has outperformed the other three major precious metals so far this year, with a modest rise of 0.8 percent, compared with a decline of nearly 25 percent in the price of palladium.

But the effect of the global slowdown on the demand side of the platinum fundamental equation is uncertain enough to make analysts cautious about the outlook for 2012, although all but one of those surveyed see greater cause for optimism in 2013.

Platinum is most widely used in jewellery, which accounts for roughly a third of total demand, while its main industrial use is in catalytic converters, mainly in diesel-powered vehicles.

EUROPEAN RISK

Last year, European demand for platinum in autocatalysts fell by 1.6 percent to 1.47 million ounces, a two-year low, according to figures from refiner Johnson Matthey.

New car registrations in the 27-member European Union, the world's largest diesel vehicle market, fell in May by 8.7 percent to 1.107 million vehicles. Monthly sales have fallen on a year-on-year basis every month since October, according to data from the European auto industry association ACEA.

“Although mine supply will likely contract in 2012 given that the South African mining industry is facing severe difficulties, more production curtailment needs to be achieved if the underlying physical surplus is to be reduced. This is all the more important given dire European auto and truck sales,” said Anne-Laure Tremblay, BNP Paribas precious metals analyst.

“Looking ahead, it is unlikely that platinum demand will recover substantially in 2012. We expect a physical market surplus to extend into 2013 and forecast platinum's return to a premium over gold only in late 2013.”

Palladium already boasts a market deficit thanks to strong demand for the metal in the world's big gasoline-powered car markets like China and the United States and to a drying up of strategic government sales by top producer Russia.

The market relies less heavily than platinum on the flagging European market and is less exposed to the impact of the debt crisis that has forced Greece, Portugal and Ireland to seek sovereign bailouts and Spain to seek a lifeline for its banks.

Analysts expect palladium to hold largely steady in 2012, but to average 20 percent more in price in 2013 than the average price in the year to date, as stability returns to the global economy and the likes of China return to robust growth.

The poll yielded a median forecast of $650 in the third quarter of the year and a forecast of $700 in the fourth quarter.

For the whole of 2012, palladium is expected to average $665, down from $720 forecast three months ago and compared with the year-to-date average of $649.99 and last year's average price of $748.30.

Analysts now predict an average price of $780 in 2013, up from $795.25.

“Palladium remains our most favoured among the commodities we cover. The market has been in a perennial supply deficit over the past few years, which has been 'filled' by releases from Russian strategic stockpiles,” Nikos Kavalis, an analyst at RBS Global Banking & Markets, said.

“As we forecast these will collapse in 2012-13 and altogether stop in 2014, we expect the market will tighten considerably.” - Reuters