Research shows that women are less likely than men to retire comfortably.

Image: RON AI

It’s a well known fact that women in South Africa earn 24% less than men, on average. This, and other unique challenges, also have a significant knock-on effect when it comes to saving for retirement.

A sobering statistic, recently released by Discovery Corporate, is that South African women retire with 21% less in retirement assets than their male counterparts.

The study also found that females were 30% more likely to make early withdrawals from their retirement savings pots, from the two-pot retirement system introduced in 2024. They're also 80% more likely to make such withdrawals in order to cover school fees.

ALSO READ: The risks of withdrawing from your Two-pot retirement system

This is all in spite of the fact that women are 20% more likely than men to make retirement contributions over and above their employer’s default rate. This may show a stronger intention to save for the future, but ultimately, several unique challenges prevent women from achieving a comfortable retirement.

“With August being National Women’s Month in South Africa, we took a deep dive into the retirement data across our umbrella funds. Our analysis shows that women are definitely saving and actively contributing towards their retirement. Yet, the system still works against them,” says Nonku Pitje, CEO of Discovery Corporate and Employee Benefits.

“While lower pay contributes to the gender retirement gap, the issue is far more complex. Women face a lifetime of unequal financial pressures and retirement systems often fail to reflect their lived experiences. These systemic shortcomings widen the gap, leaving many women financially vulnerable in retirement.”

The study found that unequal caregiving responsibilities deeply impacted their careers, with Stats SA figures showing that 43.4% of children live only with their mothers, compared to 3.9% in the case of fathers.

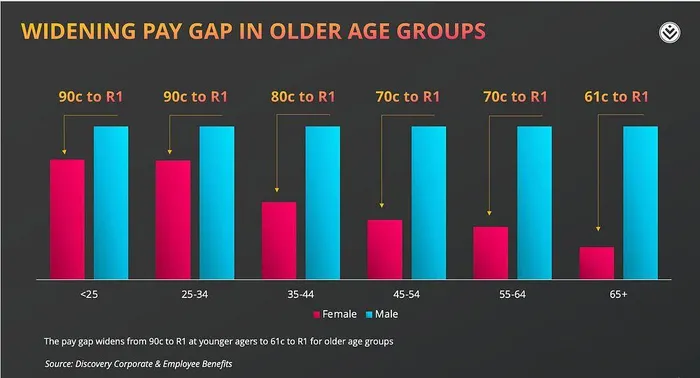

This could also lead to fewer promotion opportunities, with the 24% average gender pay gap rising to 30% among those over 45 years of age, and 39% for those aged 65 and older.

The gender pay gap in South Africa.

Image: Supplied

Compounding the retirement challenges is the fact the females, on average, live for two years longer than men.

“The gender pay gap is just the starting point. Our data highlights deeper systemic issues beyond unequal pay. Ultimately, by the time women retire, they’ve saved 21% less, will live longer, and continue to support family members across multiple generations and life stages,” Pitje said.

“The data reflects clear structural patterns and calls for benefit designs that respond to real life.”

Ralene Grobler, spokesperson for Momentum Financial Planning, said financial independence was becoming increasingly important for women.

“South African women are remarkable. They are holding down demanding jobs, providing for their families, and taking on the responsibility of caregiving for children and elderly relatives - all while facing systemic inequalities such as the 30% wage gap and single parenthood.

“Despite these challenges, women are increasingly recognising the importance of financial independence as a key indicator of success. In fact, over 60% of South African women view financial security as a top priority, according to Momentum’s research,” Grobler added.

On the upside, a recent company report shows that 45% of women are currently debt free, she added.

Discovery’s Nonku Pitje advises companies to move away from a “one size fits all” approach to employer-provided retirement funds.

“By treating benefits as a lever for equity, not just compliance, they can play a critical role in ensuring we close the gap.”

This should also be coupled with stronger financial education to help employees understand what they have, whether they’re on track and what they could do to close the gaps.

Grobler also advises female employees below the age of 50 to get serious about retirement savings.

“Your 30s and 40s are your ‘power decades’ - a time when you're likely at the peak of your earning potential and hitting major life milestones - like having children and buying a home. These years also present a prime opportunity to get intentional about your long-term financial health. By making strategic choices now, you can set yourself up for greater independence and security down the road,” Grobler explained.

“Under these circumstances, it might seem impossible to plan for what will happen in 20 years’ time. Yet the decisions you take now will have an outsized impact later on.”

She encourages females to speak to financial advisers, something too few do at present.

“Momentum’s Financial Advice Research Report found that 77% of South Africans rely on their own skills and expertise for financial decisions, and 12% ask friends and family.

“Only 9% worked with a financial adviser, and those who did were wealthier and more secure. Households that were self-reliant had the lowest wealth levels, while those who worked with an adviser had almost 10 times the amount invested as their peers,” Grobler concluded.

IOL Business

Related Topics: