Top 10 used Chinese cars dominating sales: why South African buyers are choosing them

The Chery Tiggo 4 Pro leads the top 10 rankings of used Chinese car sales.

Image: Supplied

Not too long ago, buying a Chinese car was somewhat of a gamble. People thought you were trading quality and durability for a lower price, with solid alternatives from Japan, Korea and Europe.

That reputation was built on the earliest Chinese imports, many of which failed to convince.

However, that is quickly starting to change with brands such as Chery, Haval, GWM and Omoda now firmly established, offering competitive products that match mainstream rivals on safety, build quality and day-to-day usability, often at a lower price and with more standard equipment.

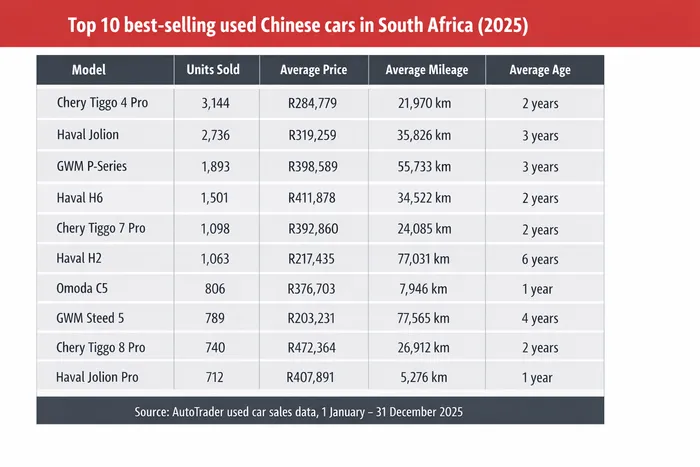

Top ten top selling Chinese cars.

Image: supplied

Pre-owned confidence

Chinese brands continue to perform strongly in the new-car market. Omoda and Jaecoo sold close to 2,500 vehicles in the third quarter of 2025, but more importantly, how that success is translating into used-car demand.

According to data from AutoTrader, buyers are no longer dipping a toe into the segment but are spending money on relatively young Chinese vehicles, often with low mileage and remaining factory warranty.

These are the 10 best-selling used Chinese vehicles in South Africa for 2025.

Chery Tiggo 4 Pro leads

The Chery Tiggo 4 Pro leads the rankings, which comes as no surprise, as it’s consistently one of South Africa’s best-selling new passenger vehicles, regularly moving more than 1,000 units a month.

That popularity also feeds into the used car market, where 3,144 examples were sold in 2025. With a wide choice of trims, multiple transmission options and different power outputs, it appeals to a broad audience.

An average used price of R284,779, mileage under 22,000km and a typical age of two years make it one of the strongest value propositions on the list.

Jolion follows

The Haval Jolion comes in second, competing in the same compact crossover segment. With fewer entry-level derivatives than the Tiggo 4 Pro, overall volumes stood at 2,736 units.

Used Jolions average R319,259, with higher mileage and older registration dates suggesting buyers are leaning towards better-specified versions. The newer Jolion Pro also features in the top 10, with fewer sales but much lower mileage and higher prices, reflecting its more recent arrival.

The GWM P-Series is one of only bakkies in the top 10.

Image: Supplied

GWM P-Series

In third place is the GWM P-Series, one of two bakkies in the top 10. With nearly 1,900 used sales, it is one of the strongest-selling double cabs on the broader used market.

An average price just under R400,000, mileage of around 55,700km and a three-year registration age make it a realistic alternative to more established bakkie brands.

Haval H6 and Chery Tiggo 7 Pro

The Haval H6 and Chery Tiggo 7 Pro sit firmly in the midsize SUV space. Both attract used buyers looking for space, comfort and technology without paying premium-brand prices.

With average ages of two years and mileage well below 40,000km, most examples on sale are still relatively fresh, reinforcing the notion that Chinese SUVs are being bought and kept, not quickly traded.

Older models are still popular

The discontinued Haval H2 remains a strong performer despite being the oldest vehicle on the list. With an average age of six years and mileage over 77,000km, it shows that earlier Chinese models are still trusted by used-car buyers.

The GWM Steed 5, while basic by modern standards, continues to appeal to cost-conscious bakkie buyers. Its affordability and simplicity keep demand steady, even with newer and more refined alternatives.

Premium positioning at used-car prices

Omoda’s C5 and the Chery Tiggo 8 Pro show how far Chinese brands have moved upmarket. The C5’s low mileage and one-year average age suggest many buyers are looking at near-new vehicles, while the Tiggo 8 Pro shows that there is an appetite for a well-priced, seven-seater SUV at close to R470,000.

As AutoTrader CEO George Mienie notes, Chinese manufacturers have narrowed the gap between price and perceived value, and the used-car market is now reflecting that shift in buyer behaviour.

Related Topics: