According to World Bank’s Safety First, crime in South Africa, including property and violent crime, is estimated to cost the economy at least 10% of GDP each year.

Image: Freepik

South Africa's roads may seem busier than ever, but beneath the surface, a persistent threat is quietly draining the economy.

Car theft and hijackings remain a costly undercurrent, not just for motorists but for businesses, insurers, and the broader economic landscape.

Numbers from the South African Police Service (SAPS) show some improvement. In the three months to September 2025, 4,778 carjackings were reported, a 12.3% decline quarter-on-quarter.

Vehicle thefts also fell, with 7,726 cases, down 10.1% over the same period. Yet these statistics only scratch the surface of a problem whose impact extends far beyond the immediate loss of a vehicle.

Beyond the police reports

Police statistics capture only part of the picture. Many crimes go unreported, creating gaps in the official data.

Statistics South Africa's Governance, Public Safety and Justice Survey takes a different approach, sampling households directly to capture both reported and unreported incidents.

The survey paints a more complete picture of the crisis. In the 2024/25 year, 59,000 men and 18,000 women experienced the theft of a motor vehicle.

Hijackings tell an even more alarming story – 99,000 men and 21,000 women faced the trauma of having their vehicle taken by force during the same period.

The cumulative toll is staggering.

Some 340,000 South Africans experienced being hijacked while travelling in a motor vehicle during the twelve months preceding the survey, if you include the passengers affected.

Take a five-year view, and that figure grows to almost half a million drivers.

"Crime remains one of the defining challenges of life in South Africa, cutting across geography, gender and economic status," the survey notes.

"Whether in bustling metropolitan centres or small rural towns, households and individuals continue to face the risk of break-ins, robberies, theft and other crimes that disrupt daily life."

The Institute for Security Studies points out a critical bias in the data.

Vehicle crimes get reported at higher rates than offences like house or street robbery – not because they're more important or traumatic, but because vehicle owners are more likely to have insurance and therefore a financial incentive to report the crime.

This creates a distortion where the minority of South Africans who own vehicles dominate certain crime statistics.

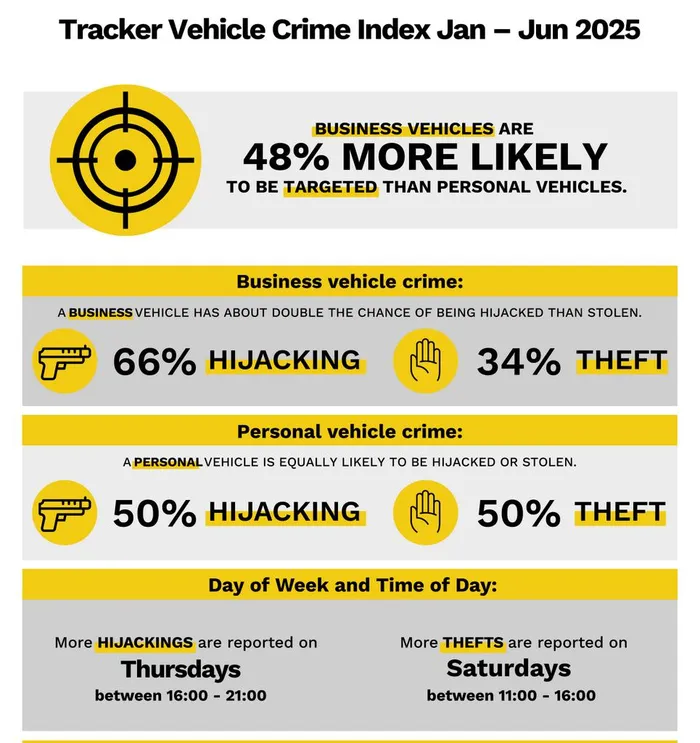

Vehicle crime in the first half of last year according to tracker.

Image: Tracker

The evolution of criminal enterprise

The thieves have evolved alongside the technology designed to stop them. Tracking companies report recovery rates between 70% and 95%, depending on various circumstances – impressive figures that also reveal an uncomfortable truth about the percentage of vehicles that simply vanish.

Criminal syndicates have developed sophisticated countermeasures. Jamming devices block GPS signals. Network problems caused by load shedding and battery theft from cell towers create dead zones where tracking fails.

Thieves now use advanced gadgets to clone key fobs, allowing them to bypass keyless entry systems and steal cars without triggering alarms. Fake license plates and signal jammers help stolen vehicles disappear into traffic.

According to CarTrack, stolen vehicles often reappear in underground networks, with organised crime syndicates targeting high-value and easily resold models. The methods employed range from bribing security guards to selling entire vehicles or parts online.

The Private Security Industry Regulatory Authority notes that stolen vehicles don't always stay in South Africa.

They're recovered locally and in neighbouring countries such as Lesotho, Zimbabwe, and Mozambique, and even as far as Angola and Nigeria. These cross-border networks suggest coordination and infrastructure that extends well beyond opportunistic local crime.

The business target

Tracker's vehicle crime statistics from January to June 2025 reveal a telling pattern: business-owned vehicles are 48% more likely to be targeted than personally owned vehicles. Nationally, hijackings of business-owned vehicles occur at nearly double the rate of thefts.

The targeting is strategic. Businesses operate on predictable schedules and routes that criminals can study. Fleet vehicles often carry valuable cargo.

Unlike personal car owners who might vary their daily patterns, businesses tend to follow established routines that make them easier targets.

Geographic concentration

Gauteng, the country's economic powerhouse, bears the brunt of vehicle crime. In June 2025, reports indicated hijackers were increasingly focusing on the province, where demand for stolen vehicles rises sharply alongside economic activity.

But the patterns are shifting. Mpumalanga has emerged as a new hotspot. The timing of incidents has also changed – Tracker reported in November that hijackings are increasingly occurring during the week rather than over weekends, suggesting professional operations aligned with business schedules rather than opportunistic weekend crime.

The DataFirst national crime dataset confirms that urban centres consistently report the highest incidence of vehicle crime, highlighting a correlation between economic activity and targeting by criminals.

Car theft in numbers.

Image: ChatGPT

The economic ripple effect

The World Bank's 2023 report on the economic cost of crime in South Africa describes how theft and violent crime ripple through the economy. Car theft increases operational costs for businesses, inflates insurance premiums, and reduces investor confidence.

The World Bank's analysis of SAPS data shows a doubling in carjackings between fiscal years 2012/13 and 2021/22. The bank attributes this surge to the rise of organised crime—criminal activities that are planned, coordinated, and conducted by structured groups.

"Organised crime has risen significantly in the past decade," the bank states.

"Defined as criminal activities that are planned, coordinated, and conducted by structured groups, organised crime tends to be more sophisticated and adaptable than more traditional, individual forms of crime."

The costs extend beyond vehicle replacement. They affect productivity, logistics, and the overall business environment.

According to the World Bank’s Safety First: The Economic Cost of Crime in South Africa, crime in South Africa, including property and violent crime, is estimated to cost the economy at least 10% of gross domestic product each year.

This encompasses direct losses, protection costs such as security and insurance, and missed economic opportunities.

The report notes that these combined costs reduce the country’s growth potential by diverting resources away from productive investment and increasing operating costs for businesses.

The private security response

Private security measures have attempted to fill perceived enforcement gaps. The Private Security Industry Regulatory Authority's 2023 Tracking Report indicates that businesses increasingly invest in tracking systems, alarms, and guarded parking to mitigate vehicle crime.

Yet the authority's report also notes several challenges that inhibit the tracking and recovery process: the prevalence of jamming devices and network-related problems caused by load shedding and theft of batteries from network towers.

Every rand spent on these defensive measures is a rand diverted from productive business investment—a hidden tax on economic activity that doesn't appear in any government budget but affects business operations nonetheless.

The path forward

As the economy recovers from pandemic-era shocks, vehicle crime remains a persistent drag on growth and confidence.

The modest improvements in quarterly statistics - the slight decreases in reported carjackings and thefts - offer limited comfort to the hundreds of thousands who have experienced these crimes over the past five years.

Efforts to curb vehicle crime span from SAPS interventions to private security innovations. The recovery rates achieved by tracking companies demonstrate what's possible with technology and coordination.

The economic loss is measured not just in stolen vehicles or insurance payouts, but in the cumulative effect of increased security spending, insurance costs, disrupted business operations, diverted investment, and the erosion of confidence that comes from knowing that despite all precautions, risk remains.

IOL BUSINESS

Related Topics: